The novelty of a new COP location normally wears off after a day or two and everyone pretty quickly gets down to business. Hopefully it will be the same here, but so far the conversation when meeting friends and colleagues in Belém goes something like this:

1. How was your travel? How many flights did you have to take? How many delays? Cancellations?

2. Isn't it hot in here? Where's the air-conditioning?

3. Have you got yourself one of those payment cards for food and drink?

4. When do you think they'll have finished building the venue?

We're happy to report that IETA's own coffee bar was being installed on Tuesday afternoon, and our audio-visual equipment has so far performed quite well, barring the occasional power failure.

Tuesday saw most negotiating tracks getting properly underway, even as Party statements were still being delivered in plenary.

A full schedule of informal consultations across most agenda items took place across the day, while high-level panels and special events were also conducted across the COP venue. There's more on the Article 6 track below.

Also on Tuesday, an update to the NDC Synthesis Report showed that global GHG emissions are projected to fall by 12% in 2035 compared to 2019 levels, based on new NDCs from 113 Parties submitted up to 9 November.

There'll be more data feeding into COP30 early on Wednesday when the International Energy Agency publishes its latest World Energy Outlook. We'll bring you some of the high-level findings.

Lastly, it might be a little early to be thinking about future COPs, but while we still don't know where countries will be meeting in 2026 – Turkey or Australia – we do now know that, pending ratification at the end of. this COP, COP32 will be taking place in Addis Ababa. Hmmmmm....

Andrea Bonzanni represented IETA at the China Pavilion on Tuesday, speaking in a stocktake of carbon market developments in China and internationally. IETA emphasised the progress made in the VCM in recent years and the convergence between voluntary and compliance demand. Other speakers in the event included vice-minister Li Gao and senior representatives from Brazil, the European Commission, the UK, the World Bank, and EDF. Credit: EDF

In the negotiations

Yesterday's opening plenary managed to absorb some potential friction on proposed additions to this year's agenda, after the Brazilian presidency deftly moved some of the new issues into informal consultations but left others aside, in particular one proposal regarding implementation of the decision on the first Global Stocktake (GST), with regard to scaling up finance to halt and reverse deforestation.

The items being consulted on are: an Indian request to discuss implementation of Paris Agreement Article 9.1 (developed countries’ obligations to provide finance); trade-restrictive unilateral measures (the CBAM question); responding to the synthesis report on NDCs and addressing the 1.5°C ambition and implementation gap; and the synthesis of biennial transparency reports.

These items will be revisited on Wednesday.

Countries also have decided to defer consideration of long-term finance, and the periodic review of the long-term global goal under the Convention and of overall progress towards achieving it to COP31.

So, the respective updated agendas are here: COP, CMP and CMA.

Parties held their first informal consultations on the Annual Report of the Supervisory Body (SBM) this afternoon. The meeting comes under agenda item 15 (b) of the CMA – the Conference of the Parties serving as the meeting of the Parties to the Paris Agreement.

As you might expect, interventions in this session kept coming back to the issue of non-permanence and reversals that has been bubbling away for a few months now. Speakers from Indonesia, Norway and Costa Rica warned that the standard as currently written does not work well for nature-based solutions, effectively excludes nature-based activities from the PACM, and even the UK warned it could become too complex at a methodological level.

Costa Rica called for a review of the expert panel composition and selection procedures to ensure diversity of expertise, including on nature-based solutions.

But Switzerland defended the non-permanence and removals standard while the EU said post-crediting monitoring and the definition of non-remediable risks are key policy issues that may require case-by-case consideration.

SBM co-chair Maria alJishi of Saudi Arabia, whose term ends at this COP, observed that under current regulations, SBM members can serve two terms, totalling four years, but are then permanently ineligible to return to any SBM role.

She warned that the limited pool of global carbon market experts makes this permanent exclusion problematic and risks undermining the technical nature of the SBM. If this issue isn't addressed this year, the issue of term limits and expert availability will need to be revisited in the coming years to prevent “running out” of technical expertise and causing the SBM to evolve into a political rather than technical body.

A few comments appeared to push back against the loosening of term limits, however, with some instead pointing to a scheduled review of the SBM's operation in 2028. (Some of our member observers pointed out that with growth in the VCM and compliance markets expected to increase very rapidly, the pool of available "talent" will likely increase at a similar pace, providing plenty of "new blood" to guide the markets in years to come.)

Numerous interventions called attention to the lack of funding for the SBM's work. The EU suggested requesting the UNFCCC Secretariat for an update on the funding shortfall across all Article 6 work, not only Article 6.4.

Later on Tuesday, a side event discussed the PACM and its role in raising integrity and ensuring impact. As our team described it, "after having been beaten up by Parties, SBM members were very defensive".

The European Union was at pains to emphasise that its recent decision to allow the limited use of carbon credits towards its 2040 target should not be viewed as having immediate relevance to Article 6, which our policy team said gave the impression that the EU was acting as if the 2040 target hadn't been agreed.

(Indeed, during the earlier consultation session on the SBM's report. the EU had indicated its opposition to a recommendation that would encourage Parties to consider using the Article 6.4 mechanism, whether as buyers or sellers, to support NDC achievement.)

Elsewhere, there was a contact group meeting on matters relating to the clean development mechanism. While IETA did not attend the meeting, we understand there was discussion on whether to use the balance of CDM funds to assist in progressing the PACM. This may help speed up the discussions on how to bring an end to the CDM.

IETA hosted a popular side event in our Boardroom to discuss new modelling insights on the economic, sectoral, and social impacts of alternative regulatory pathways under Brazil's carbon market and Article 6. Photo: Lisa Spafford.

On Tuesday, we published our annual GHG Sentiment Survey, which you can find on our website here. The main takeaway from the survey is that there is "cautious optimism" among carbon market practitioners, especially when it comes to the expansion and linkage of pricing systems. This is tempered by concerns on timelines for linkage and policy design.

As our team put it, "despite the caution, the market is more grounded, resilient and aligned around integrity as the foundation for scaling global carbon trading."

A few numbers from the survey:

91% of respondents see Article 6 as a key driver of future climate action;

30% believe the implementation of the PACM is too slow and bureaucratic;

21% think PACM is setting unrealistic methodological barriers;

39% think COP30 should be working more on integrating the VCM and PACM;

75% believe the VCM will be able to supply enough credits to meet net zero targets by 2030'

56% say that convergence between the PACM and the VCM is essential to strengthen both markets, and

27% think CORSIA Phase 1 compliance obligations will be met in full.

There's plenty of material on the various national and regional compliance markets and CBAM as well as price projections for all markets. A must-read!

And at a side event in our Boardroom, IETA presented the results of its modelling project estimating the socio-economic benefits of different carbon market frameworks in Brazil, followed by a panel discussion with key public and private sector stakeholders.

The results showed significant potential gains in Brazil's GDP, job creation, foreign investment, all with long-lasting social impacts, from engaging with Article 6.

Discussions highlighted the need for high-integrity systems and greater clarity on how the integration of voluntary, compliance, and Article 6 markets can unlock large-scale, long-term investments in decarbonisation and mitigation across the country.

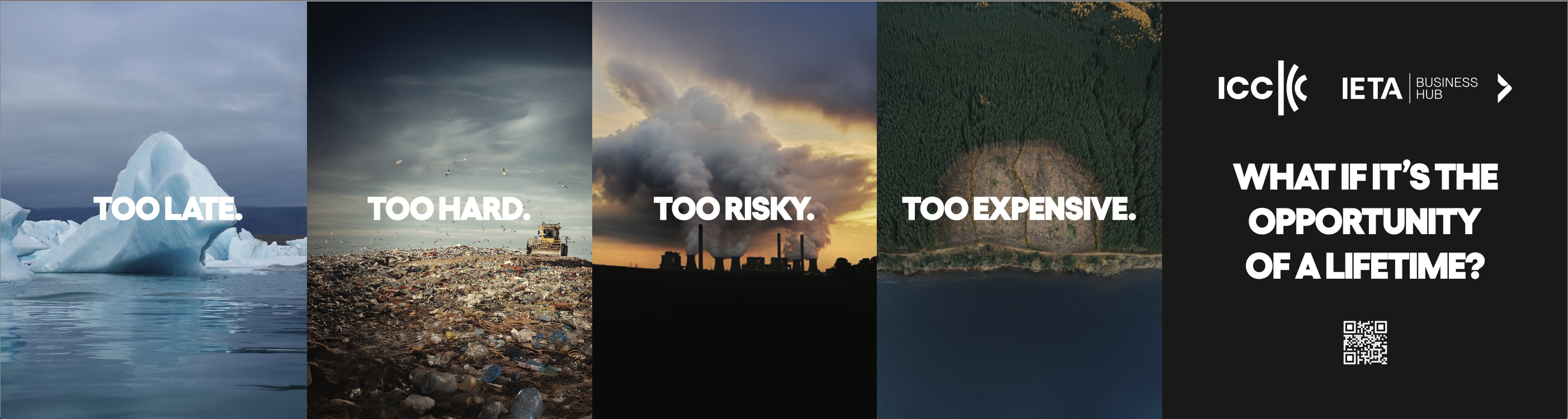

Isn't this great? An arresting display at the IETA-ICC Pavilion highlights the potential for climate action to have a positive outcome for economies and for companies. Inspiring stuff!

All event times are listed in Brasilia time (BRT), which is three hours behind GMT and 11 hours behind Singapore time.

The IETA/ICC Business Hub is located in Pavilion D145 (see image below). It's in area D of the Delegation Pavilions hall, quite close to the main entrance, and our neighbours are Colombia, the World Meteorological Organisation, Saudi Green Buildings Forum and the Oceans pavilion.

IETA has two side event venues within the Hub: the Boardroom and the Side Event Theatre. You can find the IETA schedule of events here, while the UNFCCC has produced an online schedule of side events here.

Wednesday's public programme kicks off at 1145 hrs with a session organised by 1PointFive. Direct air capture at scale is needed to meet climate goals and provide for energy security. 1PointFive is building DAC capacity while working with stakeholders to provide the needed solution for the digital issuance of carbon credits. Speakers from Carbon Finance Lab, South Pole and Terradot will join 1PointFive at this session.

At 1530 hrs, Germany's environment ministry and the Wuppertal Institute will discuss capacity-building progress to assist countries prepare for Article 6 and the VCM in order to reap the benefits of global carbon markets. Government representatives from Panama, Nigeria, Kenya and Germany, as well as from Ceezer will showcase the dynamic landscape of these capacity building programs and discuss emerging trends and future needs.